Self-Made Rich are more Generous

Fortunately most of us don't have the problem of having to decide what to do with a billion dollars but those that do have to make a choice between giving away large amounts or leaving it to their children. Intuitively it makes sense that those who make their own money are more generous than those that inherited it. I'd always assumed that it reflected the priorities and values of the family --why the family inherited money in the first place instead of donating it. Now there is a study, The Charity of the Extremely Wealthy, that states:

We find evidence that self-made billionaires are three to four times more likely to sign the Giving Pledge and to enter the Philanthropy Top 50 list of biggest pledges, compared with those who inherited their wealth. At the same time, we find that the gap in probabilities between self-made and inherited wealth is much smaller, at about 28%, when looking at the presence in the Million Dollar List. We also find that self-made billionaires give more on average than inherited billionaires do, when measuring total gifts using the Million Dollar List or the Philanthropy Top 50.

What Happens to assets if an Estate isn't Probated in Oregon?

Probate is just the court administered transfer of property after their death. Not all property is subject to the court process and sometimes it doesn't make sense to initiate a probate proceeding.

Non-Probate Property

Beneficiary Designations

Some property doesn't have to be admitted to probate in order to transfer. Think about your bank, brokerage or life insurance accounts. Often times these accounts are transferable by the beneficiary designations. When you initially opened these accounts you were probably asked to select a beneficiary. Because these accounts are contracts between you and the bank, brokerage or insurance company, the beneficiary designation will direct whoever holds your account to transfer it to your beneficiary after your death.

Below is a snip from the Servicemember Group Life Insurance application.

If you read the language carefully it says "If you do not specifically name beneficiaries, your insurance will be paid by law." What this often means is that if you don't designate a beneficiary the accounts will be paid to the estate and administered by the court.

While this is a quick and inexpensive way to transfer property after death it is very limited. Like the picture above, most companies will allow you only a few options on how you want to distribute the account. If you want to split the proceeds in a more complicated way you will need a more involved estate planning.

Keeping Beneficiary Designations up to Date

Using a beneficiary designation is only helpful if it is accurate. I suggest that you review your accounts annually to make sure the designations are accurate and up to date. It's not uncommon to find former husbands and wives as beneficiaries on accounts years after a divorce. That is not a situation anyone wants to deal with your passing.

Transferable on Death Deeds

A few years Oregon adopted a Transfer on Death Deeds. I believe most states have adopted them at this point. Much like their name implies, these deeds transfer title in real estate on your death. TODD are one of the most loved estate planning tools if you have an uncomplicated family. The primary reason an estate has to be admitted to probate is real estate. Removing real estate from the equation may let you avoid probate or allow you to settle the estate via the Small Estate process.

I've inserted a snip from ORS 93.975 that provides the form for TODD deeds.

If you only have one heir then a Transfer on Death Deed may make sense for you but anything more complicated and I would be leery of using it.

Abandoning Property

Often times someone will die owing more money than their estate is worth. When this happens, heirs sometimes decide to just walk away and let the banks foreclose on the property.

If you have any questions about how probate works or what property is included, please feel free to contact me.

Oregon Probate Jurisdiction

One of the areas that initially confuses many practitioners is the limits of jurisdiction for Oregon Probate Courts. By and large, the jurisdiction of the probate court is the same as that of the Circuit Courts. ORS 111.075 Probate Jurisdiction Vested states:

Jurisdiction of all probate matters, causes and proceedings is vested in the county courts of Gilliam, Grant, Harney, Malheur, Sherman and Wheeler Counties and in the circuit court for each other county and as provided in ORS 111.115 (Transfer of estate proceeding from county court to circuit court).

The individual county courts that are vested with probate jurisdiction are the large sparsely populated counties of Eastern Oregon including the recently famous Harney County. Although the code says these six counties are vested with the county court, all of Oregon's 36 counties' has a circuit court. I don't know why this is.

ORS 111.085 Probate jurisdiction described:

The jurisdiction of the probate court includes, but is not limited to:

(1)Appointment and qualification of personal representatives.

(2)Probate and contest of wills.

(3)Determination of heirship.

(4)Determination of title to and rights in property claimed by or against personal representatives, guardians and conservators.

(5)Administration, settlement and distribution of estates of decedents.

(6)Construction of wills, whether incident to the administration or distribution of an estate or as a separate proceeding.

(7)Guardianships and conservatorships, including the appointment and qualification of guardians and conservators and the administration, settlement and closing of guardianships and conservatorships.

(8)Supervision and disciplining of personal representatives, guardians and conservators.

(9)Appointment of a successor testamentary trustee where the vacancy occurs prior to, or during the pendency of, the probate proceeding. [1969 c.591 §5; 1973 c.177 §1]

Now that we have a general description of the kinds of matters that the probate court is interested in, what are the limits of the court's powers. A phrase you might hear is that the circuit court is "sitting in probate." ORS 11.095(1) describes those powers:

The general legal and equitable powers of a circuit court are applicable to effectuate the jurisdiction of a probate court, punish contempts and carry out its determinations, orders and judgments as a court of record with general jurisdiction, and the same validity, finality and presumption of regularity shall be accorded to its determinations, orders and judgments, including determinations of its own jurisdiction, as to those of a court of record with general jurisdiction.

What does this all mean? In essence, the probate court is the circuit court. There exist some different procedural rules that expedite the administration of the estate in uncontested proceedings but for the most part the powers of the two are the same.

Do You Really Want to Die Rich?

Due to lengthening life spans, in many cases, parental assets will not pass along as an inheritance to their "children" until they themselves are near retirement age.

I am seeing a change where people want to enjoy their estates and see the benefits of their gifts during their lifetimes. My concern is that people will give away assets that they need to survive on during their retirement though.

2016 Oregon Legislation to watch

I'm aware of three pieces of legislation that have been introduced during the Oregon Legislatures 2016 short session that relate directly to estate planning and end of life issues. The first is Revised Uniform Fiduciary Access to Digital Assets Act. This act authorizes certain fiduciaries to access electronic communications and digital assets of certain persons or decedents.

Proposed language includes:

SECTION 7.If a deceased user consented to, or a court directs, disclosure of the con-tents of electronic communications of the user, the custodian shall disclose to the personal representative of the estate of the user the content of an electronic communication sent or received by the user if the personal representative gives the custodian:(1) A written request for disclosure in physical or electronic form;(2) A certified copy of the death certificate of the user;(3) A certified copy of the letter of appointment of the personal representative or asmall estate affidavit or court order;(4) Unless the user provided direction using an online tool, a copy of the user’s will, trust, power of attorney or other record evidencing the user’s consent to disclosure of the content of electronic communications

4. DIRECTIONS TO MY HEALTH CARE REPRESENTATIVE.If you wish to give directions to your health care representative about your health care decisions, initial one of the following two statements:___ My health care representative must follow my instructions unless my medical pro-vider says my instructions are not consistent with medical standards.___ My instructions are guidelines for my health care representative to considerwhen making decisions about my care, but my health care representative should use discretion as the health situation requires.

(3)(a) Property not subject to probate administration, the transfer of which is intended by the decedent to take effect on death, is treated as an advancement against the heir’s share of the estate or the devisee’s devise under the will if declaredin writing by the decedent, or acknowledged in writing by the heir or devisee, to be an advancement. Examples of transfers under this subsection include but are not limited to beneficiary designation, right of survivorship and transfer on death deed or transfer on death designation.

Probate Pitfalls (Investing Estate Assets)

The Wall Street Journal has a great article describing some of the mistakes that can be made when settling an estate. The portion that caught my eye and inspired this post was the section on investing estate assets. While you can and sometimes should invest estate assets you can run into trouble if things don't work out.

One father named his three adult sons as executors under his estate plan, which included a pecuniary formula for funding the trust for the surviving spouse, with the balance of the estate passing to the sons. The estate consisted largely of high-quality bonds, which the sons sold shortly after their father’s death to invest in a much riskier portfolio of small-cap stocks, which they hoped would grow, Mr. Magill says. But the value of those stocks declined more than 50% before the spouse’s trust was funded at the full amount required. The sons’ resulting share bore the entire decline in the stocks’ value, resulting in a loss to them of more than $5 million.

In Oregon the General Duties of the Personal Representative is to "preserve, settle and distribute the estate in accordance with the terms of the will and ORS chapters 111, 112, 113, 114, 115, 116 and 117 as expeditiously and with as little sacrifice of value as is reasonable under the circumstances."

When the Estate has surplus assets that are not needed for the administration, the surplus assets should be invested to generate interest and income. Oregon's Probate Code section ORS 114.305 (6), focuses on short-term investments of estate assets:

Deposit funds not needed to meet currently payable debts and expenses, and not immediately distributable, in bank or savings and loan association accounts, or invest the funds in bank or savings and loan association certificates of deposit, or federally regulated money-market funds and short-term investment funds suitable for investment by trustees under ORS 130.750(Trustees duty to comply with prudent investor rule) to 130.775 (Trust language authorizing investments permitted under prudent investor rule), or short-term United States Government obligations.

Of course, this is just scratching the surface of the issues that can arise from investing estate assets. What is important to remember is that personal representatives in Oregon are only held to the standard of a prudent investor. (Compliance with the prudent investor rule is determined in light of the facts and circumstances existing at the time of a trustees decision or action and not by hindsight. ORS 130.770)

Intestate Succession in Oregon

What happens when you die without a will

When a person dies without a Will in place, the Oregon Probate Law (Intestate Succession and Wills) determines how that person’s estate will be distributed. The diagrams below will help you understand how the estate will be divided. This is not a complete list of scenarios but should give you a good idea of what can happen. In real life, families can be incredibly complicated and who inherits what can be equally as complicated.

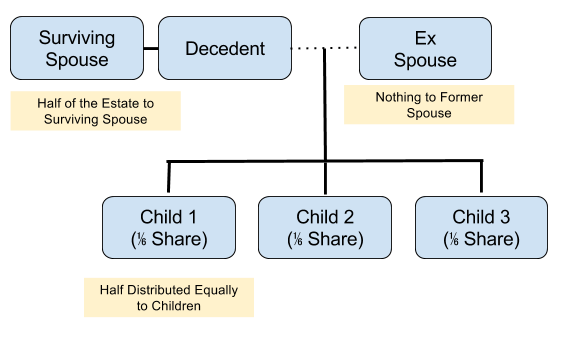

Surviving Spouse and Children

No Surviving Spouse and Surving Children

When there is no surviving spouse, the Estate is distributed evenly between the children.

Children from a Previous relationship and a surviving spouse

In this situation, the surviving spouse receives half of the estate while the Decedent’s children receive the other half distributed evenly. Former spouse receives nothing.

Parents Share when Decedent has no children or spouse

When a Decedent passes with no Spouse or Children, the surviving Parent will inherit the estate.

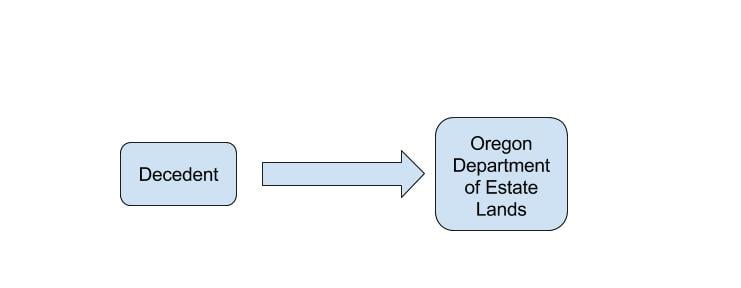

No Heirs, unable to locate heirs or heirs refuse

Caveats

There are many other situations that can arise with families. For example, parents can sometimes forfeit their share of estate because of neglect or abuse. If the heir murdered or abused the person who died, Oregon law can prevent them from inheriting property. There are also rules for grandparents inheriting property and for individuals inheriting property to two lines of relationships.

What appears first as simple can quickly become complicated when blended families, remarriages, not remarrying and other decisions we make throughout life get added to the mix.You can learn more about Oregon Probate on my practice area page.

If you have any questions on how your property will be inherited after you pass, feel free to contact me.

Search the blog and learn more about wills and probate in Oregon.

Disclaimer:

Nothing on this blog constitutes individual legal advice or creates an Attorney-Client relationship.

-

May 2023

- May 8, 2023 What is a Limited Judgment Appointing Personal Representative? May 8, 2023

- May 1, 2023 Where should I keep estate planning documents? May 1, 2023

-

April 2023

- Apr 24, 2023 How do I talk to my elderly parents about estate planning? Apr 24, 2023

- Apr 17, 2023 How do I get started in estate planning? Apr 17, 2023

- Apr 10, 2023 What questions should I ask my estate planning attorney? Apr 10, 2023

- Apr 5, 2023 Giving Appreciated Property to Charity in Oregon Apr 5, 2023

- Apr 3, 2023 How often should an estate plan or will be updated or reviewed? Apr 3, 2023

-

March 2023

- Mar 30, 2023 Is real property located outside of Oregon subject to the Oregon estate tax? Mar 30, 2023

- Mar 29, 2023 How do I find out who the personal representative of an estate is? Mar 29, 2023

- Mar 27, 2023 Why is estate planning so expensive? Mar 27, 2023

- Mar 23, 2023 Can non-residents be subject to the Oregon Estate Tax? Mar 23, 2023

- Mar 22, 2023 How do I sue a personal representative? Mar 22, 2023

- Mar 20, 2023 What are some estate planning steps that can ease financial burdens following the death of a loved one? Mar 20, 2023

- Mar 16, 2023 What is a credit shelter trust? Mar 16, 2023

- Mar 15, 2023 Who is the personal representative of an intestate estate? Mar 15, 2023

- Mar 13, 2023 How does a probate or personal representative bond work? Mar 13, 2023

- Mar 9, 2023 Does Oregon have a gift tax? Mar 9, 2023

- Mar 8, 2023 How can I leave money to my son but not his wife? Mar 8, 2023

- Mar 6, 2023 What is a power of attorney? Mar 6, 2023

- Mar 2, 2023 What is the importance of a schedule K-1 for an estate? Mar 2, 2023

- Mar 1, 2023 Overview of the Oregon Estate Tax Mar 1, 2023

- Mar 1, 2023 Oregon Estate Tax and the Fractional Formula Mar 1, 2023

- Mar 1, 2023 Can My Mother Leave Me Out of Her Will? Mar 1, 2023

-

February 2023

- Feb 27, 2023 What is a pour-over will? Feb 27, 2023

- Feb 24, 2023 How to remove squatters from a deceased person's home. Feb 24, 2023

- Feb 20, 2023 How can a revocable trust avoid a conservatorship? Feb 20, 2023

- Feb 17, 2023 A dead person owes me money, how do I file a claim? Feb 17, 2023

- Feb 16, 2023 What are the Oregon inheritance or succession laws? Feb 16, 2023

- Feb 13, 2023 What is a "revocable trust" or "living trust"? Feb 13, 2023

- Feb 6, 2023 Can property be transferred without probate? Feb 6, 2023

-

January 2023

- Jan 30, 2023 What happens to a bank account when someone dies without a beneficiary? Jan 30, 2023

- Jan 23, 2023 What is a Payable on Death bank account? Jan 23, 2023

- Jan 17, 2023 What happens if I don’t go through probate? Jan 17, 2023

- Jan 9, 2023 Does Oregon have a Transfer on Death deed? Jan 9, 2023

- Jan 2, 2023 What Triggers Probate in Oregon? Jan 2, 2023

- Jan 1, 2023 What is the 65 day rule for estates and trusts? Jan 1, 2023

-

May 2022

- May 10, 2022 Can a Will Avoid Probate? May 10, 2022

-

April 2022

- Apr 25, 2022 How Do You Avoid Probate in Oregon? Apr 25, 2022

- Apr 7, 2022 Must an Estate Go Through Probate in Oregon? Apr 7, 2022

-

March 2022

- Mar 28, 2022 How much does an estate have to be worth to go to probate in Oregon? Mar 28, 2022

-

September 2021

- Sep 3, 2021 We are closed for Labor Day. Sep 3, 2021

- Sep 2, 2021 How Long Does Probate Take in Oregon? (Updated for COVID) Sep 2, 2021

- Sep 2, 2021 How does probate work without a will in Oregon. Sep 2, 2021

-

January 2018

- Jan 18, 2018 2018 Oregon Estate Tax Rates Jan 18, 2018

- Jan 18, 2018 Is a Handwritten Will Valid in Oregon? Jan 18, 2018

-

December 2017

- Dec 18, 2017 Oregon Probate Fees in 2017 Dec 18, 2017

-

August 2017

- Aug 2, 2017 2017 Oregon Estate Tax Rates Aug 2, 2017

-

March 2017

- Mar 9, 2017 Oregon Probate Inventory Mar 9, 2017

-

November 2016

- Nov 26, 2016 Basics of an Oregon Estate Plan (Part 3) Nov 26, 2016

- Nov 8, 2016 Basics of an Oregon Estate Plan (Part 2) Nov 8, 2016

- Nov 1, 2016 Basics of an Oregon Estate Plan (Part 1) Nov 1, 2016

-

October 2016

- Oct 24, 2016 Duties of an Oregon Personal Representative Oct 24, 2016

-

September 2016

- Sep 6, 2016 Oregon Estate Planning Timeline Sep 6, 2016

-

June 2016

- Jun 23, 2016 How Long Does Probate Take in Oregon? Jun 23, 2016

- Jun 20, 2016 How to File for Probate in Oregon Jun 20, 2016

-

May 2016

- May 17, 2016 When is Probate required in Oregon? May 17, 2016

- May 6, 2016 Oregon Probate Bond May 6, 2016

- May 5, 2016 Oregon Personal Representative Checklist May 5, 2016

- May 3, 2016 Compensation of Personal Representative in Oregon May 3, 2016

-

April 2016

- Apr 29, 2016 2016 Oregon Estate Tax Rates Apr 29, 2016

- Apr 25, 2016 Probating Joint Bank Accounts in Oregon Apr 25, 2016

- Apr 19, 2016 How much does Probate cost in Oregon? Apr 19, 2016

-

March 2016

- Mar 3, 2016 What is a Guardianship in Oregon? Mar 3, 2016

-

February 2016

- Feb 26, 2016 Elements of an Oregon Estate Plan Feb 26, 2016

- Feb 24, 2016 Faith Based Estate Planning in Oregon Feb 24, 2016

- Feb 23, 2016 March Events Feb 23, 2016

- Feb 16, 2016 Self-Made Rich are more Generous Feb 16, 2016

- Feb 10, 2016 What Happens to assets if an Estate isn't Probated in Oregon? Feb 10, 2016

- Feb 8, 2016 Oregon Probate Jurisdiction Feb 8, 2016

- Feb 5, 2016 Do You Really Want to Die Rich? Feb 5, 2016

- Feb 4, 2016 2016 Oregon Legislation to watch Feb 4, 2016

- Feb 2, 2016 Probate Pitfalls (Investing Estate Assets) Feb 2, 2016

-

January 2016

- Jan 14, 2016 Intestate Succession in Oregon Jan 14, 2016

- Jan 13, 2016 Estate Planning for Unmarried Seniors Jan 13, 2016

- Jan 12, 2016 What does an Oregon Probate Attorney do? Jan 12, 2016

-

December 2015

- Dec 31, 2015 End of Life Decision Making in Oregon Dec 31, 2015

- Dec 21, 2015 Free Oregon Estate Planning Workshop Dec 21, 2015

- Dec 17, 2015 Non-borrowing surviving spouse can retain home subject to Reverse mortgage Dec 17, 2015

- Dec 15, 2015 Free Oregon Small Estate Affidavits Dec 15, 2015

- Dec 3, 2015 Estate Planning for Digital Assets Dec 3, 2015

-

October 2015

- Oct 29, 2015 2015 Budget Deal putting an end to "File-and-Suspend" Social Security strategy Oct 29, 2015

- Oct 21, 2015 End of Year Estate Planning Oct 21, 2015

- Oct 12, 2015 Disinheriting Parents in Oregon Oct 12, 2015

- Oct 1, 2015 Inheriting Property when there is no Will. Oct 1, 2015

-

September 2015

- Sep 29, 2015 Negative Wills in Oregon Sep 29, 2015

- Sep 25, 2015 2016 Oregon Probate Law Modernization Sep 25, 2015

- Sep 21, 2015 The Probate Process in Oregon Sep 21, 2015

- Sep 15, 2015 2015 Oregon Estate Tax Rates Sep 15, 2015