How Long Does Probate Take in Oregon? (Updated for COVID)

In the Covid Era, estates are taking longer to administer than they were a few years ago. The administration of a probate estate takes a minimum of 4 Months in Oregon. The typical amount of time is closer to 7 to 10 months depending on the nature of the assets and the backlog at the court house.

I have written about the Probate Process in Oregon and created an Oregon Personal Representative Checklist to help my clients better understand the proceedings. You can also find more information by searching the blog on the right.

Oregon Probate Fees in 2017

How Much Does Probate Cost in Portland Oregon?

I have broken down the common court costs and fees that associated with probating an estate in Oregon. For 2017, the uncontested estates that I helped administer ranged from $2632.50 to $4,950.00. In contested estates where the heirs are arguing over the validity of a will or the distribution of property, the costs with be much higher.

Breakdown of Probate Legal Fees

| Service | Cost |

|---|---|

| 2017 Court Filing Fees | $558.00 |

| Publication Fees | $128.00 |

| 2017 Attorney Fee Average (Uncontested Administration) | $4183.59 |

The averages were calculated from estates I helped administer for my clients in Clackamas, Multnomah and Washington Counties.

The size of the estate didn't seem to increase the cost of the administration. Homes in foreclosure and large debts tended to increase the attorney fees the most in uncontested administrations. The estates that didn't have homes in foreclosure averaged closer to $2,500.

Other Costs

By far the largest cost in the majority of probates in Oregon are the realtor fees. I have a previous post that goes more in depth into How Much Does Probate Cost in Oregon if you want to learn more.

Oregon Probate Inventory

What is required on an estate inventory.

One of the first tasks must be completed during the administration of an estate is the inventory. The inventory must be completed within 60 (the timeline has been changed to 90 days) days of the appointment of a personal representative and provide estimates of the value of the property as of the date of death.

ORS 113.165 Filing inventory and evaluation

Within 60 days after the date of appointment, unless a longer time is granted by the court, a personal representative shall file in the estate proceeding an inventory of all the property of the estate that has come into the possession or knowledge of the personal representative. The inventory shall show the estimates by the personal representative of the respective true cash values as of the date of the death of the decedent of the properties described in the inventory.

Determining the values of assets is generally straightforward. You can look at the balance of a bank account or investment account at the date of death.

Hiring Appraisers

Sometimes the estate will have unusual or unique property that must be appraised. Oregon law allows the personal representative to hire an appraiser that will be paid by the estate as a necessary expense.

ORS 113.185 Appraisement

(1) The personal representative may employ a qualified and disinterested appraiser to assist the personal representative in the appraisal of any property of the estate the value of which may be subject to reasonable doubt. Different persons may be employed to appraise different kinds of property.

(2) The court in its discretion may direct that all or any part of the property of the estate be appraised by one or more appraisers appointed by the court.

(3) Property for which appraisement is required shall be appraised at its true cash value as of the date of the death of the decedent. Each appraisement shall be in writing and shall be signed by the appraiser making it.

(4) Each appraiser is entitled to be paid a reasonable fee from the estate for services and to be reimbursed from the estate for necessary expenses.

Personal Items and Household Goods.

Generally speaking, it is fine to lump the household goods and personal items together on the inventory. If the items have a substantial value, they should be listed individually on the inventory.

When determining a "substantial value", most attorneys rely on 26 CFR 20.2031-6 - Valuation of household and Personal effects.

(b) Special rule in cases involving a substantial amount of valuable articles. Notwithstanding the provisions of paragraph (a) of this section, if there are included among the household and personal effects articles having marked artistic or intrinsic value of a total value in excess of $3,000 (e.g., jewelry, furs, silverware, paintings, etchings, engravings, antiques, books, statuary, vases, oriental rugs, coin or stamp collections), the appraisal of an expert or experts, under oath, shall be filed with the return. The appraisal shall be accompanied by a written statement of the executor containing a declaration that it is made under the penalties of perjury as to the completeness of the itemized list of such property and as to the disinterested character and the qualifications of the appraiser or appraisers.

Amended and Supplemental Inventories

Occasionally the personal representative will have to correct or add information to the inventory that was filed with the court.

When the information filed with the court was incorrect, the personal representative must file an amended inventory to correct that mistake.

A supplemental inventory is required when the personal representative finds property of the estate after the original inventory has been filed.

Other types of assets

Real estate located outside of Oregon should not placed on the inventory. Certain beneficial interests may or may not be listed on the inventory. You should talk to your attorney if you have any questions regarding beneficial interests.

Duties of an Oregon Personal Representative

You've been appointed the Personal Representative. Now what do you do?

When you are appointed as the personal representative in a will or by the laws of intestate succession, you may and may not be sure what being a personal representative requires.

The duties of a personal representatives are described by statute as:

ORS 114.265, General duties of personal representative

A personal representative is a fiduciary who is under a general duty to and shall collect the income from property of the estate in the possession of the personal representative and preserve, settle and distribute the estate in accordance with the terms of the will and ORS chapters 111, 112, 113, 114, 115, 116 and 117 as expeditiously and with as little sacrifice of value as is reasonable under the circumstances.

In plain English this means that the Personal Representative must:

- Safeguard the property of the decedent’s estate. If it is necessary for property to not be in the possession of the personal representative, then a custody receipt should be used.

- Open a separate estate bank account and deposit all checks and cash of the estate.

- Notify Heirs and Beneficiaries.

- File an inventory of the decedent’s assets with estimated values.

- Determine the creditors of the estate and pay valid claims. If the estate does not have enough money to pay all creditor claims, then the claims will be paid according to priority of claims set out by statute.

- File state and federal income tax returns and pay taxes. Prepare a Federal and State Estate tax return if one is required.

- If the Estate Administration lasts longer than a year, then the personal representative must file an annual inventory with the court.

- Receive court approval before paying fees to the personal representative or before distributing property to the heirs or beneficiaries.

You Can Find More Information

- On our Probate Practice Page.

- Review blog posts about probate.

- Search our website in the box on the right side of the page.

How Long Does Probate Take in Oregon?

The administration of a probate estate takes a minimum of 4 Months in Oregon. The typical amount of time is closer to 5-7 months depending on the nature of the assets and the backlog at the court house.

To speed up the process, I make sure that the Personal Representative is well informed regarding the process and has a plan on how to administer the estate before filing with the court.

I have written about the Probate Process in Oregon and created an Oregon Personal Representative Checklist to help my clients better understand the proceedings. You can also find more information by searching the blog on the right.

Oregon Probate Bond

What are Probate Bonds?

A probate bond is a bond issued to protect the heirs and creditors of an estate from the negligence or dishonesty of a personal representative. A personal representative may have sloppy bookkeeping or does not properly and timely deal with claims of the estate. Less often, the personal representative may act dishonestly and steal the assets or gamble them away. In these situations a bond will protect the heirs and creditors from the loss.

When are Probate Bonds Required in Oregon?

ORS 113.105 describes the necessity and amount of bond. Generally speaking, if a will says that no bond shall be required or if the personal representative is the sole heir or devisee no bond will be required.

If the will requires a bond, or doesn't mention bonding, or if the person died without a will and has multiple heirs, the court will require that a bond be filed with the court before letters of administration or testamentary are issued.

The court also has discretion to require a bond even if the will says no bond is necessary.

How Large of a Probate Bond will be Required?

The court looks at three things in order to determine the amount of bond:

- The nature, liquidity and apparent value of the assets of the estate.

- The anticipated income during administration.

- The probable indebtedness and taxes.

The court is required by statute to ensure that the bond is adequate to protect interested persons of the estate.

Qualifying for a Bond.

The bond will be issued to the personal representative by a surety company authorized to transact surety business in this state. The surety company will look at the personal representatives credit report and assets when deciding the amount the personal representative qualifies for.

If the personal representative doesn't qualify for bond required by the court, other options have to be explored.

- Finding a personal representative that does qualify for the bond. This can be done by having the personal representative nominated in the will or preferred by statute decline to serve.

- Restricting estate assets. Typically the real estate (houses) of the deceased are listed as restricted in the petition. This restriction prevents the real estate from being sold without a court order. Because real estate is usually the largest asset of the estate, this will reduce the bond greatly.

- Waiver of Bond by interested parties. The court may, in its discretion, "waive the requirement of a bond if all devisees and heirs known to the court agree in writing that the requirement be waived and the signed agreement is filed with the court at the time of filing of the petition for the appointment of a personal representative." ORS 113.105(4)

If you have any additional questions regarding bonding or probate in general, search the blog in the box on the right or feel free to contact me.

2016 Oregon Estate Tax Rates

The Oregon Estate Tax rate for 2016 is left unchanged from 2015.

| Taxable Estate Equal to or more than: | Taxable Estate less than: | Tax rate on Taxable Estate amount more than column 1 |

|---|---|---|

| $1,000,000 | $1,500,000 | $0 + 10% |

| 1,500,000 | 2,500,000 | 50,000 + 10.25% |

| 2,500,000 | 3,500,000 | 152,500 + 10.5% |

| 3,500,000 | 4,500,000 | 267,500 + 11% |

| 4,500,000 | 5,500,000 | 367,500 + 11.5% |

| 5,500,000 | 6,500,000 | 482,500 + 12% |

| 6,500,000 | 7,500,000 | 602,500 + 13% |

| 7,500,000 | 8,500,000 | 732,500 + 14% |

| 8,500,000 | 9,500,000 | 872,500 + 15% |

| 9,500,000 | 1,022,500 + 16% |

Elements of an Oregon Estate Plan

What is Estate Planning?

There is much confusion about what estate planning is and what you actually need to do. I will go through some of the most common estate planning tools, how they work and when they are useful.

1. The Do-Nothing Option

This is probably the most common estate planning technique in Oregon and rarely is it ideal. If you die in Oregon without a will, your assets will be distributed by the laws of intestate succession. These laws are the Oregon Legislature's best guess of how most people would have wanted their assets divided among their heirs. Typically your assets will be inherited by your surviving spouse or equally among a class of heirs. If you are more interested, I have a full post dedicated to the common intestate scenarios linked here. You can also learn more about Oregon Probate on my practice area page.

2. Last Will and Testament

The basic Will is the simplest and most well known estate planning tool. They are generally assumed to have been invented in Ancient Greece around 600 BC. (Wikipedia has an article on the History of Wills.) At its simplest, a Will appoints someone to manage your estate after your death and provides them instructions on how to distribute your assets.

In Oregon you must have "testamentary capacity" in order to create a will. Testamentary capacity defined:

ORS 112.225 Who may make a willAny person who is 18 years of age or older or who has been lawfully married, and who is of sound mind, may make a will.

Now, there are several formalities that you have to follow in order have a duly executed will. I often hear complaints about these formalities. It is best to think about these formalities not as burdens but rather as quality control measures that make sure people don't steal from you after you die.

Oregon outlines the formalities of a duly executed Will in the ORS.

112.235 Execution of a willA will shall be in writing and shall be executed with the following formalities:

(1) The testator, in the presence of each of the witnesses, shall: (a) Sign the will; or (b) Direct one of the witnesses or some other person to sign thereon the name of the testator; or (c) Acknowledge the signature previously made on the will by the testator or at the testators direction. (2) Any person who signs the name of the testator as provided in subsection (1)(b) of this section shall sign the signers own name on the will and write on the will that the signer signed the name of the testator at the direction of the testator. (3) At least two witnesses shall each: (a) See the testator sign the will; or (b) Hear the testator acknowledge the signature on the will; and (c) Attest the will by signing the witness name to it. (4) A will executed in compliance with the Uniform International Wills Act shall be deemed to have complied with the formalities of this section.

There is much more to cover on the topic of Wills but this post is meant as an overview for estate planning.

3. Revocable Trusts

Sometimes marketed a "living trusts" or "loving trusts," a revocable trust is a contract with yourself that you can "revoke" if you change your mind. I've written about revocable living trusts in Oregon before but I will recap their uses here as well.

Many people have difficulty understanding how a revocable trust works so I've diagrammed it below.

The two most common uses for revocable trusts in estate planning are the avoidance of probate and conservatorship.

Avoiding Probate

The most common reason why probate proceeding are started in Oregon is because the titled property of the estate exceed the statutory amounts for small estate proceedings. (I will go into small estate proceedings later.) What that means in non-lawyer speak is that your home is worth more than $200,000. There are other ways to exceed the small estate limits but for most people it is the value of their home.

So, by placing your home and other assets into a revocable trust you can avoid probate all together or be able to settle your estate by Affidavit of Claiming Successor. When done properly, a revocable trust can avoid several thousand in probate administration fees and save months of time. Revocable trusts don't avoid estate taxes or shield assets from creditors. There are other tools that can be used to minimize taxes and protect assets and I will discuss those in a later post.

Avoiding Conservatorship

Conservatorship is a kind of protective proceeding in Oregon where the court appoints a conservator to manage the assets and finances of a protected or incapacitated person.

ORS 125.005 (3) defines financially incapable:

Financially incapable means a condition in which a person is unable to manage financial resources of the person effectively for reasons including, but not limited to, mental illness, mental retardation, physical illness or disability, chronic use of drugs or controlled substances, chronic intoxication, confinement, detention by a foreign power or disappearance. Manage financial resources means those actions necessary to obtain, administer and dispose of real and personal property, intangible property, business property, benefits and income.

As people aged they sometimes experience diminished mental capacity or conditions that make it difficult to manage their financial affairs. In these instances it may be necessary to go to court to establish a conservatorship and appoint a conservator. These can be expensive and time consuming proceedings so it is best to avoid them.

A revocable trust can avoid conservatorship by appointing a successor trustee if you become incapacitated. You can provide instructions in your trust on who you want to manage it and how you want it managed in the event you become incapacitated.

4. Advanced Medical Directives and POLST

For many people how they die is often more important than what happens to their belongings. I've written extensively on Advanced Medical Directives and Substituted Healthcare Decision Making before and how a person's faith influences medical decision making.

In a nutshell, Advanced Medical Directives allow you to appoint a Healthcare decision maker and leave instructions for end-of-life treatment. POLST (Physicians Orders for Life Sustaining Treatment) all you to decide what treatment you want if you have a terminal disease. I encourage all of my clients to complete their Advanced Medical Directives and POLST if they do no other estate planning. I will often hear from a family member who had to guess at their loved-one's desires for medical treatment in the ICU and are traumatized by the experience.

If you have any questions about Advanced Medical Directives, please follow the links above or leave a comment.

5. Virtual Asset Instruction Letter

This is a new area of estate planning that deals with virtual assets and how you would like them handled after your passing. For many of us the majority of our communications and photographs now exist on the servers of Google, Facebook, Apple and Microsoft. I wrote about this before (What is going to happen to your Facebook account when you die?) I've also written about Grieving Online.

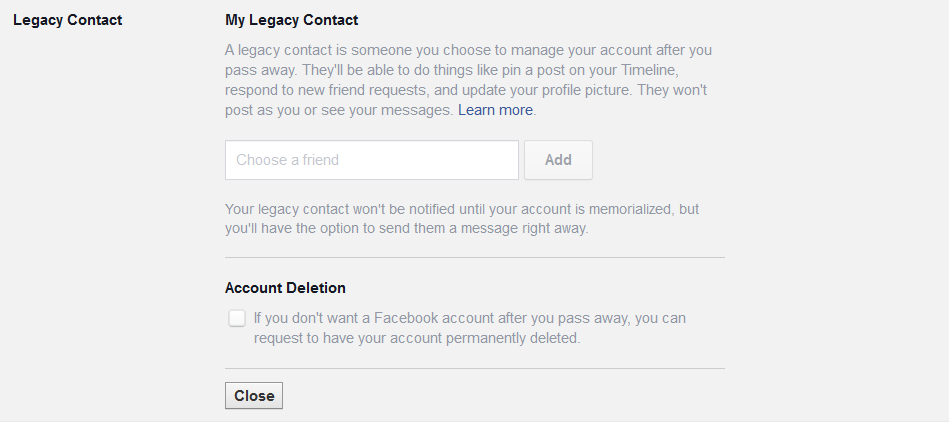

How these accounts are handled after your death depends on the Terms of Service of each of the companies. What is important is that you decide who you want to have access to these accounts and what you want them to do with them. Facebook allows you to add a legacy contact to manage your account or to delete your account after your death. Below is a snip from the Facebook Legacy Account Page. Other companies are creating similar programs to help you manage your accounts if you die.

The Virtual Asset Instruction Letter (VAIL) can work alongside your other estate planning documents and provide guidance to the person administering your estate. The VAIL can contain the passwords and logins for your accounts along with directions. Logins and access to financial institutions should be controlled by the Will or Trust but you may want to list them here as well but that is not what VAILs are typically designed to manage.

I would use a VAIL to give instructions about who you want to have copies of your emails or photos after your death. For example, you may have quite a bit of email correspondence with your grandchildren in a gmail account and you may want to provide copies of those emails to them.

For those of you who have monetized Youtube, Instagram or other accounts I would contact an estate planning attorney to advise you on the managing those accounts.

6. Beneficiary Designations and Payable on Death

Certain property does not need to pass through probate in order to be transferred to your heirs or devises. Most often this non-probate property are accounts that allow you designate a beneficiary. These accounts are basically contracts between you and the company holding your account. When you pass away the company will pay or allow access to the account without going through probate.

I explain beneficiary designations and non-probate property in more detail in a previous post. This most important thing to remember is to keep your beneficiary designations up to date and to review them regularly.

7. Specialty Trusts

There are many other specialty trust that are used in estate planning. The most common are Special Needs Trusts, Gun Trusts and Pet Trusts.

Special Needs Trusts

Special Needs Trusts are designed to hold property for a disabled person while at the same time allowing them to utilize government benefits. When creating a special needs trust, great care should be taken so that any government benefits under medicaid or SSI are not disrupted. I will discuss Special Needs trusts in more depth in a later post.

National Firearm Act Gun Trusts

These are trusts created to hold and purchase weapons regulated under the National Firearms Act. The purpose of a Gun Trust is to eliminate much of the burden of owning and transferring what are known as Title 2 devices (machine guns, sawed-off shotguns, grenade launchers, etc.) I think most of the marketing around gun trusts is based on fear mongering but there are some legitimate uses if you have NFA Firearms or a large/unique firearm collection.

Pet Trusts

A pet trust provides for the care of your pet if you are to die or become disabled.

Conclusion

I hope you have found this overview of common estate planning tools helpful. This is by no means an exhaustive list of options nor is it meant as advice for your situation.

If you have any questions please search the blog, contact me or leave a comment below. As always, please read the Disclaimer in the sidebar before commenting. It is there for your protection.

Intestate Succession in Oregon

What happens when you die without a will

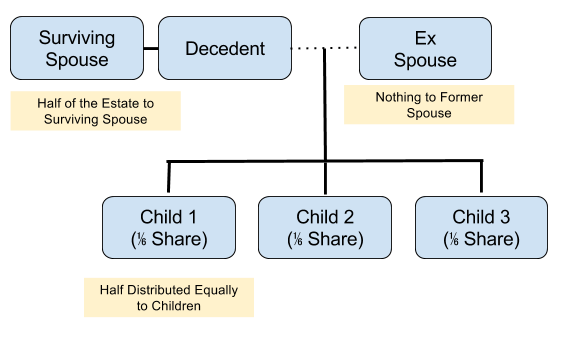

When a person dies without a Will in place, the Oregon Probate Law (Intestate Succession and Wills) determines how that person’s estate will be distributed. The diagrams below will help you understand how the estate will be divided. This is not a complete list of scenarios but should give you a good idea of what can happen. In real life, families can be incredibly complicated and who inherits what can be equally as complicated.

Surviving Spouse and Children

No Surviving Spouse and Surving Children

When there is no surviving spouse, the Estate is distributed evenly between the children.

Children from a Previous relationship and a surviving spouse

In this situation, the surviving spouse receives half of the estate while the Decedent’s children receive the other half distributed evenly. Former spouse receives nothing.

Parents Share when Decedent has no children or spouse

When a Decedent passes with no Spouse or Children, the surviving Parent will inherit the estate.

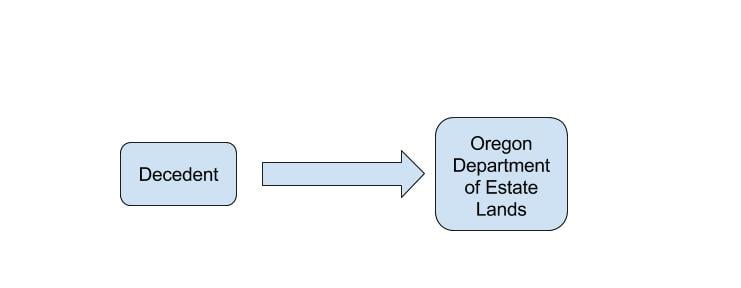

No Heirs, unable to locate heirs or heirs refuse

Caveats

There are many other situations that can arise with families. For example, parents can sometimes forfeit their share of estate because of neglect or abuse. If the heir murdered or abused the person who died, Oregon law can prevent them from inheriting property. There are also rules for grandparents inheriting property and for individuals inheriting property to two lines of relationships.

What appears first as simple can quickly become complicated when blended families, remarriages, not remarrying and other decisions we make throughout life get added to the mix.You can learn more about Oregon Probate on my practice area page.

If you have any questions on how your property will be inherited after you pass, feel free to contact me.

Search the blog and learn more about wills and probate in Oregon.

Disclaimer:

Nothing on this blog constitutes individual legal advice or creates an Attorney-Client relationship.

-

May 2023

- May 8, 2023 What is a Limited Judgment Appointing Personal Representative? May 8, 2023

- May 1, 2023 Where should I keep estate planning documents? May 1, 2023

-

April 2023

- Apr 24, 2023 How do I talk to my elderly parents about estate planning? Apr 24, 2023

- Apr 17, 2023 How do I get started in estate planning? Apr 17, 2023

- Apr 10, 2023 What questions should I ask my estate planning attorney? Apr 10, 2023

- Apr 5, 2023 Giving Appreciated Property to Charity in Oregon Apr 5, 2023

- Apr 3, 2023 How often should an estate plan or will be updated or reviewed? Apr 3, 2023

-

March 2023

- Mar 30, 2023 Is real property located outside of Oregon subject to the Oregon estate tax? Mar 30, 2023

- Mar 29, 2023 How do I find out who the personal representative of an estate is? Mar 29, 2023

- Mar 27, 2023 Why is estate planning so expensive? Mar 27, 2023

- Mar 23, 2023 Can non-residents be subject to the Oregon Estate Tax? Mar 23, 2023

- Mar 22, 2023 How do I sue a personal representative? Mar 22, 2023

- Mar 20, 2023 What are some estate planning steps that can ease financial burdens following the death of a loved one? Mar 20, 2023

- Mar 16, 2023 What is a credit shelter trust? Mar 16, 2023

- Mar 15, 2023 Who is the personal representative of an intestate estate? Mar 15, 2023

- Mar 13, 2023 How does a probate or personal representative bond work? Mar 13, 2023

- Mar 9, 2023 Does Oregon have a gift tax? Mar 9, 2023

- Mar 8, 2023 How can I leave money to my son but not his wife? Mar 8, 2023

- Mar 6, 2023 What is a power of attorney? Mar 6, 2023

- Mar 2, 2023 What is the importance of a schedule K-1 for an estate? Mar 2, 2023

- Mar 1, 2023 Overview of the Oregon Estate Tax Mar 1, 2023

- Mar 1, 2023 Oregon Estate Tax and the Fractional Formula Mar 1, 2023

- Mar 1, 2023 Can My Mother Leave Me Out of Her Will? Mar 1, 2023

-

February 2023

- Feb 27, 2023 What is a pour-over will? Feb 27, 2023

- Feb 24, 2023 How to remove squatters from a deceased person's home. Feb 24, 2023

- Feb 20, 2023 How can a revocable trust avoid a conservatorship? Feb 20, 2023

- Feb 17, 2023 A dead person owes me money, how do I file a claim? Feb 17, 2023

- Feb 16, 2023 What are the Oregon inheritance or succession laws? Feb 16, 2023

- Feb 13, 2023 What is a "revocable trust" or "living trust"? Feb 13, 2023

- Feb 6, 2023 Can property be transferred without probate? Feb 6, 2023

-

January 2023

- Jan 30, 2023 What happens to a bank account when someone dies without a beneficiary? Jan 30, 2023

- Jan 23, 2023 What is a Payable on Death bank account? Jan 23, 2023

- Jan 17, 2023 What happens if I don’t go through probate? Jan 17, 2023

- Jan 9, 2023 Does Oregon have a Transfer on Death deed? Jan 9, 2023

- Jan 2, 2023 What Triggers Probate in Oregon? Jan 2, 2023

- Jan 1, 2023 What is the 65 day rule for estates and trusts? Jan 1, 2023

-

May 2022

- May 10, 2022 Can a Will Avoid Probate? May 10, 2022

-

April 2022

- Apr 25, 2022 How Do You Avoid Probate in Oregon? Apr 25, 2022

- Apr 7, 2022 Must an Estate Go Through Probate in Oregon? Apr 7, 2022

-

March 2022

- Mar 28, 2022 How much does an estate have to be worth to go to probate in Oregon? Mar 28, 2022

-

September 2021

- Sep 3, 2021 We are closed for Labor Day. Sep 3, 2021

- Sep 2, 2021 How Long Does Probate Take in Oregon? (Updated for COVID) Sep 2, 2021

- Sep 2, 2021 How does probate work without a will in Oregon. Sep 2, 2021

-

January 2018

- Jan 18, 2018 2018 Oregon Estate Tax Rates Jan 18, 2018

- Jan 18, 2018 Is a Handwritten Will Valid in Oregon? Jan 18, 2018

-

December 2017

- Dec 18, 2017 Oregon Probate Fees in 2017 Dec 18, 2017

-

August 2017

- Aug 2, 2017 2017 Oregon Estate Tax Rates Aug 2, 2017

-

March 2017

- Mar 9, 2017 Oregon Probate Inventory Mar 9, 2017

-

November 2016

- Nov 26, 2016 Basics of an Oregon Estate Plan (Part 3) Nov 26, 2016

- Nov 8, 2016 Basics of an Oregon Estate Plan (Part 2) Nov 8, 2016

- Nov 1, 2016 Basics of an Oregon Estate Plan (Part 1) Nov 1, 2016

-

October 2016

- Oct 24, 2016 Duties of an Oregon Personal Representative Oct 24, 2016

-

September 2016

- Sep 6, 2016 Oregon Estate Planning Timeline Sep 6, 2016

-

June 2016

- Jun 23, 2016 How Long Does Probate Take in Oregon? Jun 23, 2016

- Jun 20, 2016 How to File for Probate in Oregon Jun 20, 2016

-

May 2016

- May 17, 2016 When is Probate required in Oregon? May 17, 2016

- May 6, 2016 Oregon Probate Bond May 6, 2016

- May 5, 2016 Oregon Personal Representative Checklist May 5, 2016

- May 3, 2016 Compensation of Personal Representative in Oregon May 3, 2016

-

April 2016

- Apr 29, 2016 2016 Oregon Estate Tax Rates Apr 29, 2016

- Apr 25, 2016 Probating Joint Bank Accounts in Oregon Apr 25, 2016

- Apr 19, 2016 How much does Probate cost in Oregon? Apr 19, 2016

-

March 2016

- Mar 3, 2016 What is a Guardianship in Oregon? Mar 3, 2016

-

February 2016

- Feb 26, 2016 Elements of an Oregon Estate Plan Feb 26, 2016

- Feb 24, 2016 Faith Based Estate Planning in Oregon Feb 24, 2016

- Feb 23, 2016 March Events Feb 23, 2016

- Feb 16, 2016 Self-Made Rich are more Generous Feb 16, 2016

- Feb 10, 2016 What Happens to assets if an Estate isn't Probated in Oregon? Feb 10, 2016

- Feb 8, 2016 Oregon Probate Jurisdiction Feb 8, 2016

- Feb 5, 2016 Do You Really Want to Die Rich? Feb 5, 2016

- Feb 4, 2016 2016 Oregon Legislation to watch Feb 4, 2016

- Feb 2, 2016 Probate Pitfalls (Investing Estate Assets) Feb 2, 2016

-

January 2016

- Jan 14, 2016 Intestate Succession in Oregon Jan 14, 2016

- Jan 13, 2016 Estate Planning for Unmarried Seniors Jan 13, 2016

- Jan 12, 2016 What does an Oregon Probate Attorney do? Jan 12, 2016

-

December 2015

- Dec 31, 2015 End of Life Decision Making in Oregon Dec 31, 2015

- Dec 21, 2015 Free Oregon Estate Planning Workshop Dec 21, 2015

- Dec 17, 2015 Non-borrowing surviving spouse can retain home subject to Reverse mortgage Dec 17, 2015

- Dec 3, 2015 Estate Planning for Digital Assets Dec 3, 2015

-

October 2015

- Oct 29, 2015 2015 Budget Deal putting an end to "File-and-Suspend" Social Security strategy Oct 29, 2015

- Oct 21, 2015 End of Year Estate Planning Oct 21, 2015

- Oct 12, 2015 Disinheriting Parents in Oregon Oct 12, 2015

- Oct 1, 2015 Inheriting Property when there is no Will. Oct 1, 2015

-

September 2015

- Sep 29, 2015 Negative Wills in Oregon Sep 29, 2015

- Sep 25, 2015 2016 Oregon Probate Law Modernization Sep 25, 2015

- Sep 21, 2015 The Probate Process in Oregon Sep 21, 2015

- Sep 15, 2015 2015 Oregon Estate Tax Rates Sep 15, 2015